Not financial advice, for entertainment and research purposes only

Ticker: DR.TO

Market Cap: CAD $223m / US$162m

Credit to Smoak Capital Management and Trident Opportunities for previously flagging this opportunity

Thesis in a Nutshell

Owner of high-quality specialty surgery hospitals in the USA trading at a 8x P/FCF multiple, and a ~50% discount to public comps + private M&A multiples

Formal strategic turnaround strategy announced and being implemented, with 20% (and counting) of SOI repurchased, corporate costs being slashed and company executing on sale of non-core assets

Activist investor involved, has replaced management and board

Attractive acquisition target with management and major shareholders clearly signaling a willingness to transact

Upcoming Q4 earnings to be reported in early March is historically MFCs strongest trading period as patients seek to utilise medical benefits before year end expiry. A strong print could catalyze renewed interest in the name.

Background

Medical Facilities Corp (MFC) is a Toronto stock exchange listed owner of specialty surgery hospitals in the United States. MFC owns a majority stake (generally 51%) in each of its hospitals, with the minority stake held by a partnership of physicians who work at the respective facility, and are responsible for managing its operations.

Revenue is generated by patients who pay;

a professional fee: paid directly to their physician and,

a facility fee: paid to the hospital and split pro rata between MFC and the physician partnership.

Historically, MFC utilised a debt-funded acquisition strategy, which focused on growing a monthly dividend payment that averaged ~7% on an annualised basis. This reliable income stream was attractive to Canadian retail investors who were the natural holders of the stock.

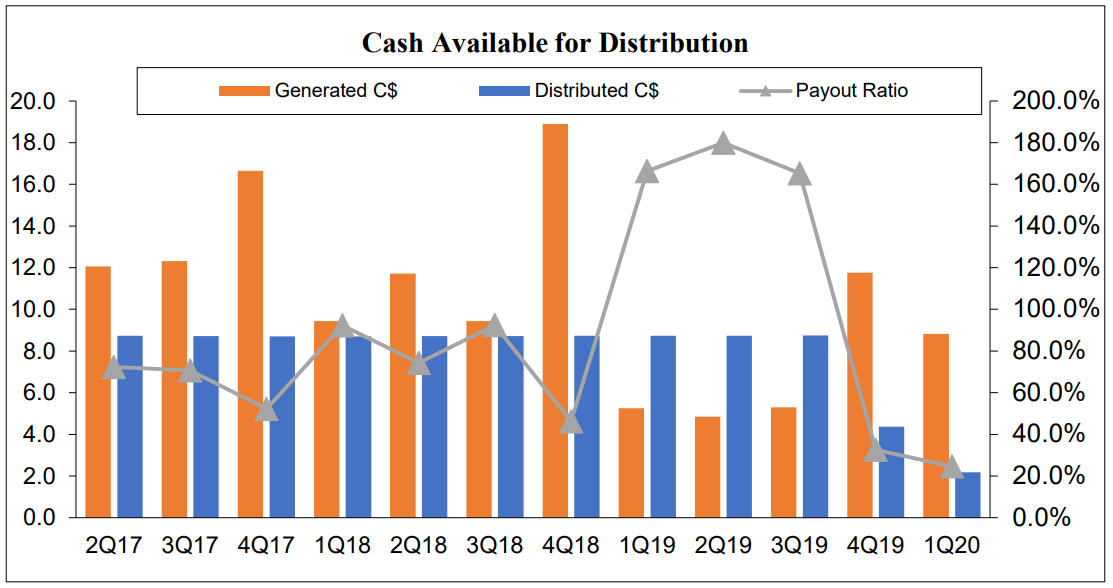

MFC performance was unremarkable up until Q1 2019 when the underperformance of major acquisition UMASH and accelerating corporate costs led to a 28% (YoY) / 60% (QoQ) decrease in income from operations, with cash generation falling below dividend payments. Performance failed to improve in the subsequent quarter, and MFC fired their CFO and took a $30m impairment charge against the embattled UMASH facility.

Despite these operational difficulties, management resolutely maintained their dividend payout for the next 3 quarters, with payout ratios in excess of 160% as MFC resorted to debt funding their monthly dividend payments. In Q4 2019, MFC was inevitably forced to drastically cut their dividend, and shift to a quarterly distribution cycle.

Things went from bad to worse when after multiple dividend cuts, MFCs operations were impacted by the outbreak of COVID-19, leading to significant disruptions to surgery volumes and MFC shares ultimately falling >80% from March 2019 to their trough in March 2020.

However, aggressive government support enabled MFC to tread water through the pandemic, and as COVID impacts receded, the company was able to maintain a ~3.5% dividend yield at a <40% payout ratio while gradually paying down debt.

By Q1 2022, MFC had reduced net debt from $133m to $35m, divested some under-performing assets (including a majority stake in UMASH), and was valued at just 7.5x P/FCF. The business had stabilised, was generating attractive free cash flow and unsurprisingly attracted the attention of institutional investors, including activist investor Convarium Capital.

Strategic Overhaul

Over the course of 2022, at the behest of major shareholders led by Convarium, MFC undertook a board, management and strategic overhaul that included;

The replacement of 4 Directors (out of 6, and including the Chair) with new representatives “as a result of the shift in the Corporation’s strategic direction”

A formal new strategy announcement which included a direct commitment for MFC to “suspend acquisitions, divest its non-core assets, pursue overhead cost reductions, and evaluate and implement strategies to return capital to its shareholders”

The repurchase of 10% of shares on issue through an off-market tender offer

Implementation of an ongoing on-market buyback program

The appointment of a new CEO - Jason Redman - in Oct 2022

Business Today

Fast forwarding to today, the business has successfully executed on its stated, capital return-focused strategy. Notably, since Q1 2022;

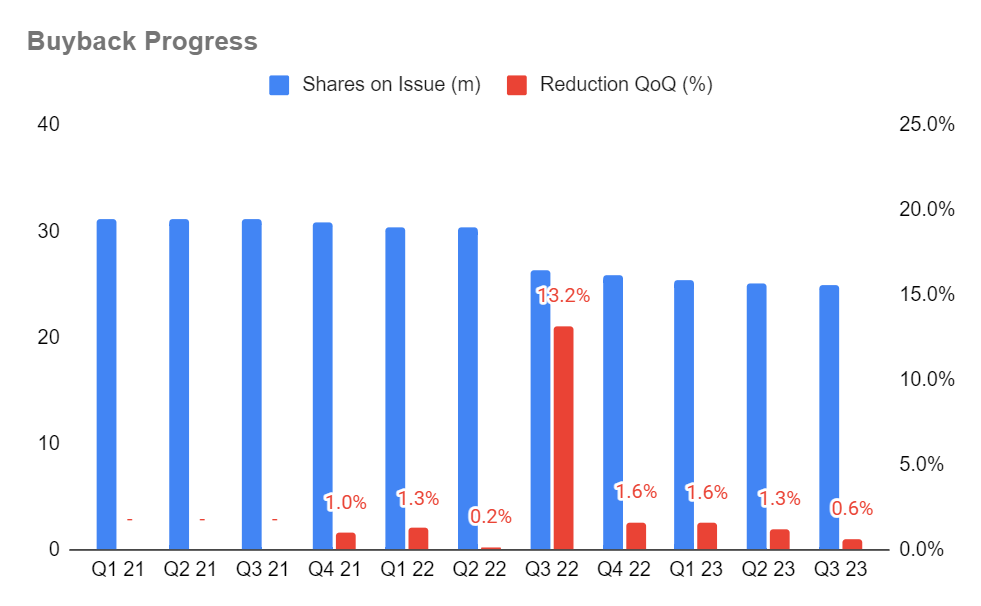

Shares on issue has decreased by 18%, with a fresh on-market buyback recently approved in November 2023

Non-core assets have been progressively divested, including the marginally profitable Nueterra Ambulatory Surgery Centre business

Corporate costs run rate reduced by ~$4m annually, and the COO and CDO (chief development officer) have resigned and not been replaced

MFC’s remaining assets are detailed below, notably the 4 hospitals that generate ~99% of free cash flow are all highly reviewed and awarded facilities, and should be viewed as top decile assets in my opinion.

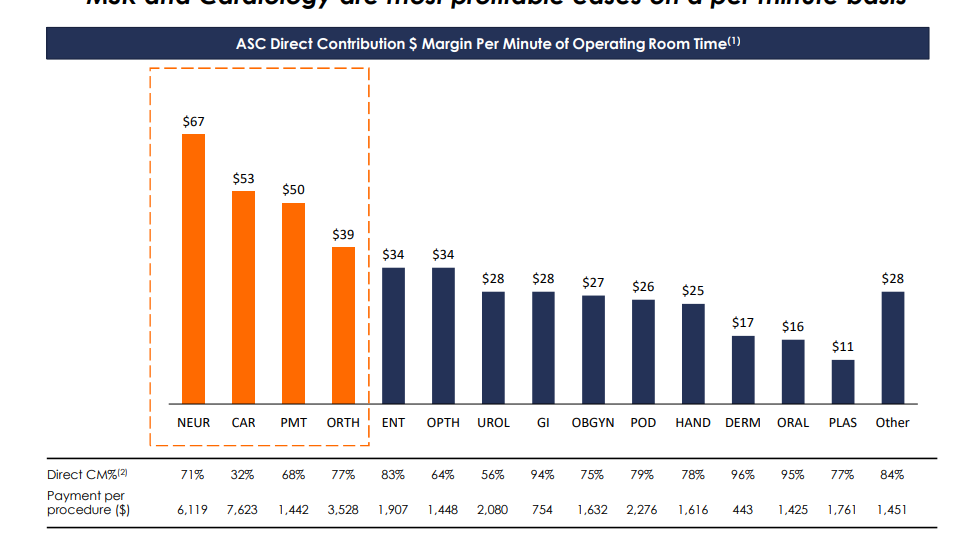

Fundamentally, these are long-standing and high quality facilities, in areas with growing populations, that are providing essential surgical procedures with a focus on procedures favorably exposed to aging US demographics including orthopedics, spine, pain management, and neurosurgery.

As informed by analysis from listed surgery hospital roll-up operator Surgery Partners, these specialty procedures are amongst the most profitable on a margin / operating room time basis.

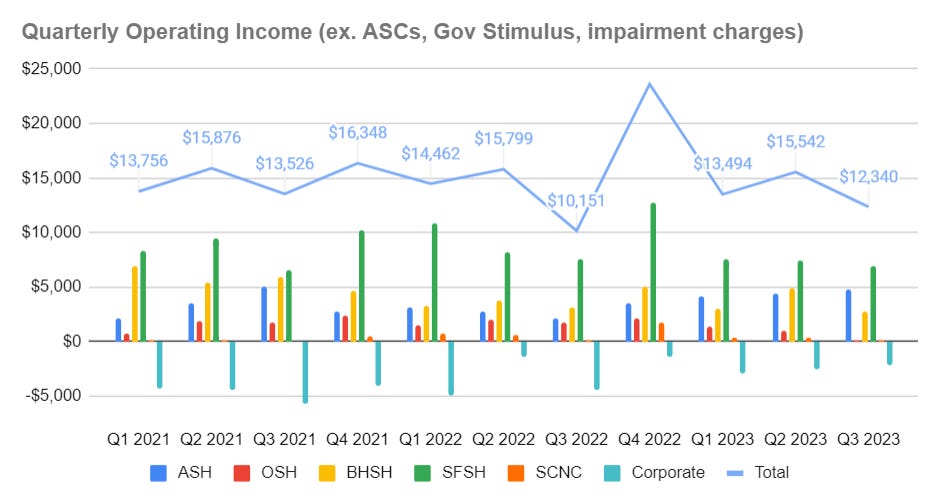

From an operational perspective, underlying hospital performance has been steady if unspectacular in recent quarters, with inflation-led margin pressure on operating costs broadly offset by a substantial reduction in corporate costs. Detailed below is MFC quarterly operating income adjusted for divestitures, government stimulus funding, and impairment charges to give a relatively ‘clean’ view of underlying performance.

It is important to note that there is substantial seasonality in MFC earnings, with Q3 traditionally the weakest and Q4 the strongest as patients seek to utilise healthcare benefits before they expire at year end.

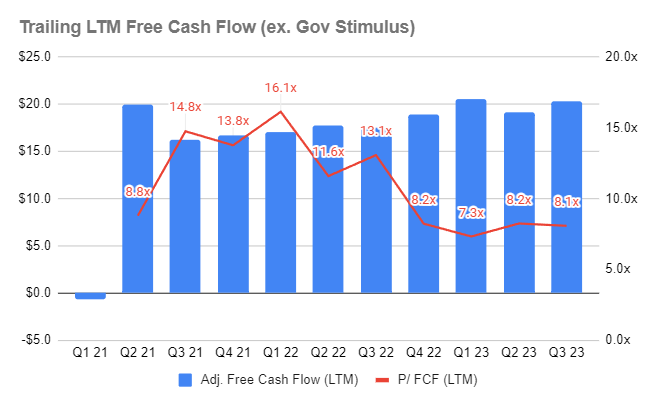

In order to get a cleaner view of the cash generation capacity of the business, we can narrow our view to free cash flow to equity, again with government stimulus income removed for avoidance of doubt.

As we can see, free cash flow is steadily improving, and significantly, excess cash flow is being aggressively funneled into buybacks, with a >20% reduction in shares on issue being recorded since 2021.

Valuation

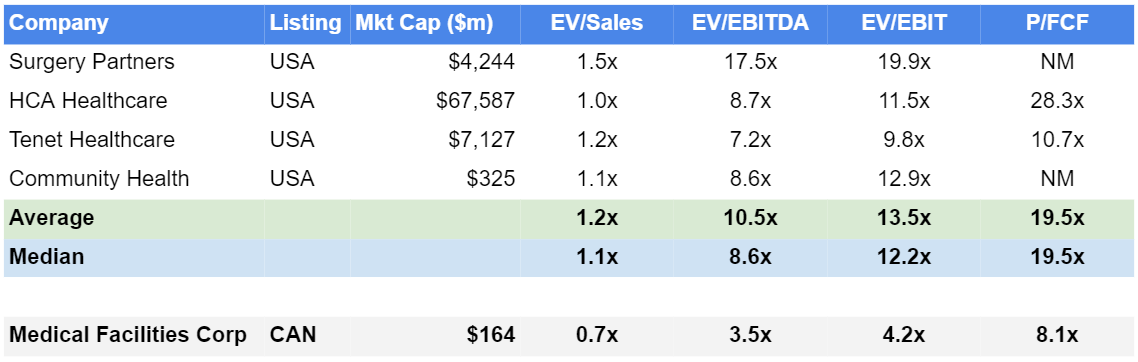

A valuation of MFC is not immediately straightforward, owing to the significant minority ownership of each hospital by partner physicians. However, on a non-adjusted basis, we can see that MFC is trading at a material discount to listed peers.

Please note: MFC (and its competitors) have significant minority partner interests in their underlying hospitals, which can make multiple comparison misleading on an EV basis.

Part of this discount is justified, given MFCs smaller scale (which reduces operating leverage from shared billing and supply chain) and historical operational issues, so a more revealing valuation can be obtained by an analysis of the underlying hospital assets within MFC.

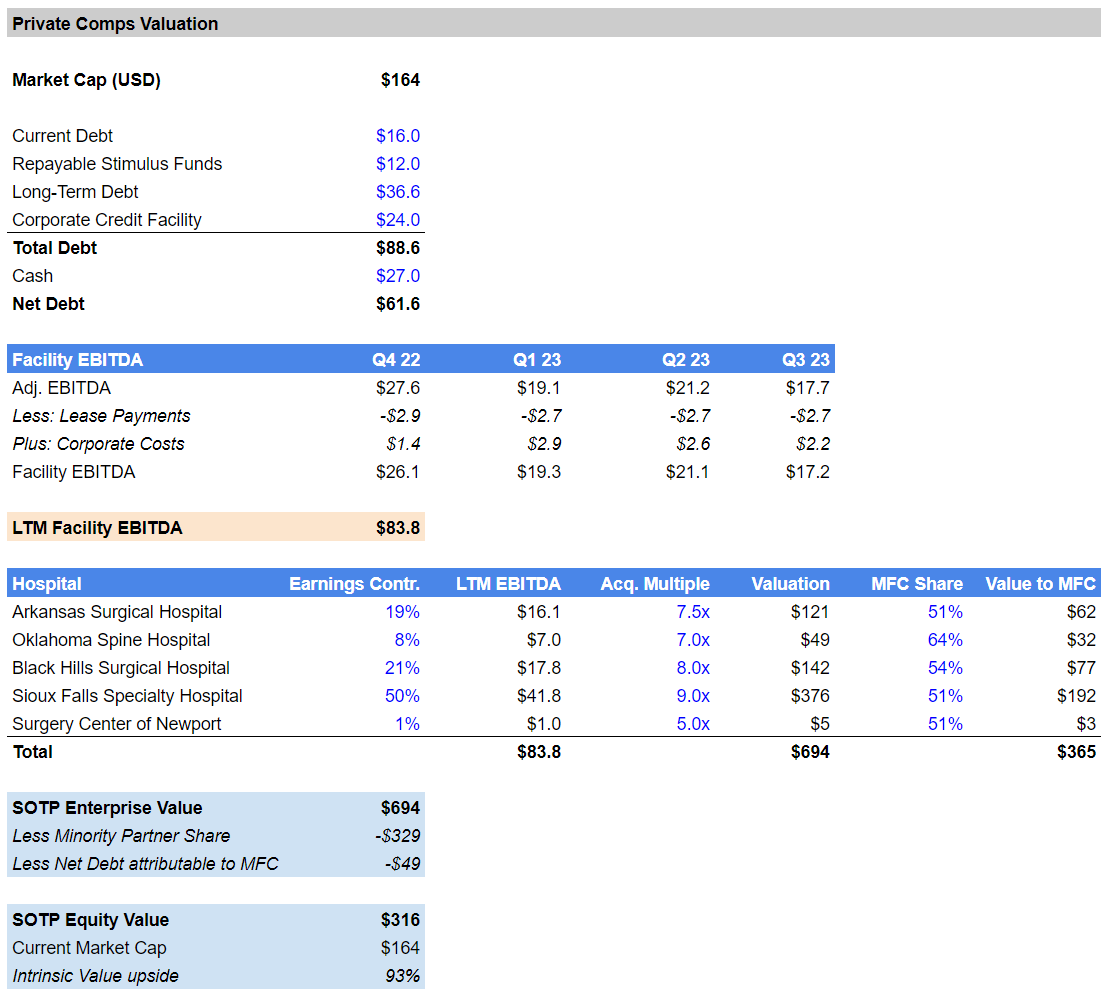

As a sense check; given MFC has halted all growth plans, is aggressively returning capital, and actively selling off its assets, it is appropriate to look to private market M&A comps to calculate a reasonable exit valuation.

Listed competitor Surgery Partners has disclosed it paid an average 8x EV/EBITDA multiple for its acquisitions from 2018 to 2021 (and signaled similar values for 2022). Given Surgery Partners is a credible acquirer candidate for MFC itself, we use this multiple as a baseline, adjusting for the relative quality of MFCs facilities based on their cashflow generation capacity.

MFC does not disclose EBITDA at the facility level, but this can be ascertained by adjusting companywide EBITDA to include lease payments and remove corporate costs (given an acquirer would not bear this cost). We then take this total facility level figure and apply it pro rata per hospital to determine EBITDA at the facility level.

Backsolving from this SOTP valuation (see summary below), I value MFC equity at $316m vs. a $164m market cap (a 93% premium), although note that this ignores transaction costs and tax impacts for simplicity.

Clearly, whether comparing to public or private market valuation marks, MFC appears to be materially undervalued and hence its current buyback program is highly accretive.

Rationale for Valuation Discount

Orphaned Stock: transition from yield-focused retail owned name to ‘shrinking to greatness’ strategy has left MFC without a natural buying pool. This is further exaggerated by the fact that MFC is an illiquid, Canadian listed, small-cap stock with all US operations.

Complex Financials: MFC has complicated financial reporting, with a litany of one-off adjustments in recent years. These adjustments negatively impact headline numbers and include a number of historical asset write-downs and reversals of government funding grants that obscure the underlying performance of the business. Significantly I view the MFC balance sheet as now largely ‘clean’, with downside scenarios already recognised.

Poor Screening: MFC’s physician partners have a right to exchange up to 15% of their facility ownership for shares in MFC. This right is recognised as a balance sheet liability and is incorrectly picked up in net debt figures by investment screening services, leading to potential investors seeing an inflated debt balance by $41m unless financials are reviewed in detail. Additionally, MFC has $12m in funds repayable to the government which are still being adjudicated and may not be payable.

Seasonality: Q3 is a historically weak quarter for MFC, and the last two years have seen November selloffs following the release of Q3 financials which inevitably disappoint on a QoQ basis. Encouragingly, Q4 is the reverse in that it is the historically strongest quarter as patients seek to utilise healthcare benefits before they expire at year-end.

Risks

Margin Pressure: MFCs facilities are yet to return to pre-COVID levels of cashflow generation as a result of margins that have been squeezed by inflationary pressures, notably labour expenses. However, management have flagged in recent updates that these pressures are becoming less pronounced.

Regulatory: US healthcare costs are disproportionately high on a relative global basis and continue to rise at a rate exceeding CPI. This increases the risk of government intervention which could potentially negatively impact for profit providers.

M&A: sustained high interest rates may serve to chill the healthcare M&A sector, leading to a delay in value realisation / a reduction in exit value.

Conclusion

Put succinctly, MFC is a highly cash generative business, operating in a defensive industry, and trading at 8x P/FCF which represents a ~50% discount to public and private comps. Beyond this, the company is actively returning capital to shareholders, reducing corporate expenses, divesting non-core assets, and has committed not to undertake potentially value destructive M&A.

Ultimately, I expect value realisation to occur with MFC being sold wholesale to a competitor / PE firm. In the meantime, shareholders are paid to wait with a 3.6% dividend yield as the company continues to undertake a highly accretive buyback program.

Disclaimer - I have a long position in DR.TO

Do not interpret anything above as financial advice. This article has been prepared for informational & educational purposes only. The writing contains certain forward-looking statements and opinions which are based on the Author’s analysis of publicly available information believed to be accurate and reliable. These statements and opinions are subject to unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. As of the date the Report is published, the Author holds a position in the security mentioned. Nothing in this Report constitutes investment advice. Readers should conduct their own due diligence and research and make their own investment decisions.