Playmates Toys - 869.HK

September 2023

Not financial advice, for entertainment and research purposes only

Ticker: 869.HK

Market Cap: $HK909m / US$115m

Share Price: $HK0.77

Credit to VIC user Light62 for flagging this opportunity

Thesis in a Nutshell

Playmates Toys (Playmates) is a Hong Kong listed creator, designer, marketer and distributor of children’s toys, predominantly Teenage Mutant Ninja Turtles (TMNT) action figures.

Playmates currently trades at a depressed valuation -7% below the value of cash and liquid securities on its balance sheet - despite having a profitable underlying business. This is a result of the extreme cyclicality of its sales, which are tied to the cultural relevance of the TMNT franchise.

A new TMNT movie was released in August 2023, and is being followed by a 2 season tv series and sequel movie which I posit will continue to revive interest in TMNT figurines. Over the next ~3 years, I expect Playmates’ earnings to be materially elevated, and the company to payout substantial dividends.

Background

Established in 1966, Playmates Toys creates and distributes children’s toys under the brands; Teenage Mutant Ninja Turtles, Star Trek, Miraculous Ladybug and Spy Ninjas.

Playmates’ business was transformed in the late 1980s when it launched a range of TMNT action figures shortly after the initial release of an TMNT animated tv show. This partnership was a cash bonanza for the business, with Playmates controlling an estimated ~60% of the global action figure market in 1990.

In a ‘Walmart Effect’ style relationship, Playmates became entirely dependent on the TMNT license, and swung to operating losses as cultural interest in the brand waned between various iterations of the tv show and movies. At the peak of the last TMNT cycle, the brand contributed 95% of Playmates’ revenue.

In recent years, Playmates has been active in diversifying its business into a limited subset of alternate brands, and has managed to maintain modest operating profitability despite cyclically low interest in the TMNT brand. Notably, Playmates had a HK$56m operating profit in 1H 2023 (its cyclically slower half) without a meaningful contribution from its recently released new line of TMNT toys.

Playmates doesn’t provide a breakdown for its sales across various brands, but on a geographical basis sales are USA (60%), Europe (25%) Asia-Pac (5%) Other (10%).

Where is the Value?

Playmates is currently trading at an 8% discount to the value of its cash and liquid public equity portfolio as outlined below. Importantly, there is a clear business justification for this lazy balance sheet, with Playmates having aspirations to sign licensing agreements with additional tier 1 figurine brands. Such arrangements are typically structured as 5-10 year contracts, and require the manufacturer to guarantee annual minimum payments of ~US$10m / HK$80m per year at signing. As a result, Playmates needs to maintain (but not necessarily increase) its existing cash balance in order to compete for these major brands and diversify further beyond TMNT.

Playmates used the prior TMNT boom in 2013-2016 to build up its cash balance to the requisite level for these partnerships. As a result, I expect that excess cashflows in the upcoming TMNT cycle will be available for distribution to shareholders, and the company has signaled its commitment to this approach. As a (minor) proof point, Playmates made a 2c per share dividend payment to shareholders in 2H2022 and 1H2023 for the first time since 2018.

Discount to Cash

Simplified Balance Sheet

Catalysts for Improving Performance

The latest TMNT movie released in Aug-23 received warm critical reception (in contrast to its poorly reviewed predecessors) and a solid showing at the box office with a current worldwide box office gross of $167m.

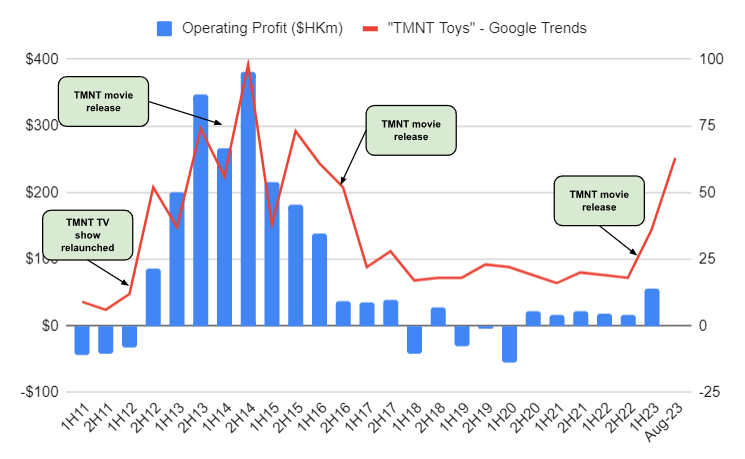

Perhaps more importantly, Paramount and Nickelodeon have committed to a 2 season tv series and a sequel movie following the success of this latest reboot. This will help to extend the critical period of audience interest into which Playmates is able to leverage toy sales for its TMNT line. To demonstrate how tightly linked these factors are, I chart below Playmates’ long-term operating profit vs. Google Trends interest in “TMNT Toys”.

While I’m unable to project forward sales with any reasonable degree of accuracy given the wide range of potential outcomes and contingency on the ongoing success of the upcoming tv show and sequel movie, the likelihood of a material uplift in earnings over the next 2-3 years (and a resulting boost to dividend payouts) appears favourably skewed.

Another substantive tailwind is the material increase in global interest rates, given the quantity of cash on Playmates’ balance sheet. These holdings are predominantly invested in short term USD treasuries which currently yield >5%. At current levels, this equates to $HK45m in annual earnings, or a 5.5% earnings yield for the entire business at current market cap, ignoring all operating earnings.

Finally, it's important to note Playmates improving operating performance in recent months despite TMNT sales being yet to flow through to the PNL. With 1H23 Operating Profit of $HK56m vs. $HK19m in 1H22. This is evidence that Playmates additional licenses are starting to generate meaningful returns, and provides an additional lever for growth / diversification away from TMNT.

Earnings Cycle Potential

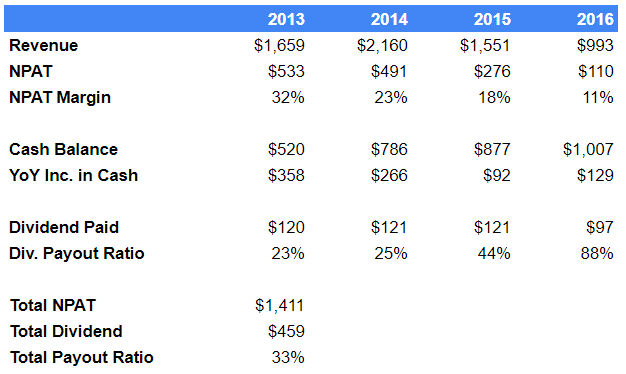

As established previously, the upcoming 3-4 year cycle of TMNT tv shows + a sequel movie is the critical period for Playmates to realise a material uplift in earnings. For context, the prior cycle of 2013-2016 produced cumulative net income of $HK1.4Bn with $HK0.46Bn in dividends distributed. Again, this compares to a current market cap of the business today of HK$909m and an enterprise value that is marginally negative.

Crucially, this prior cycle was used to build up cash holdings to the level required to compete for Tier 1 contracts, and so a significantly higher dividend payout ratio can reasonably be assumed going forward.

Prior Cycle Earnings Summary

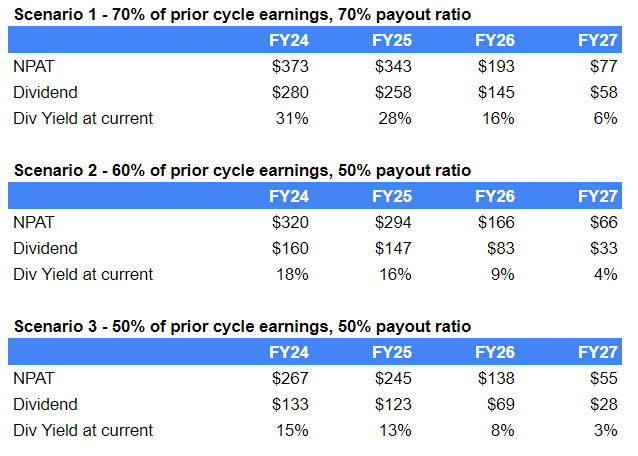

In order to (very) roughly approximate scenarios for this cycles’ potential earnings I assume a relatively conservative 70-50% discount in earnings to the prior cycle (given the latest movie has grossed less than the prior iteration). Additionally I assume a higher dividend payout ratio of 50-70% as the company has established there is no need to continue to build cash on the balance sheet.

This is clearly a highly imprecise forecast method but it can at least show a range of possible forward looking outcomes if the latest TMNT series approaches the popularity of previous iterations. Notably this scenario analysis does not include upside interest earnings from Playmates’ substantial cash balance given the current rate environment, or any growth from other Playmates branded lines which can bring additional upside.

Ownership / Management

Playmates is a family business, majority owned (~51%) by conglomerate Playmates Holdings which is HK listed and controlled by the Chan family. The Playmates Holdings CEO is the scion of the family business and he has installed his son as the CEO of Playmates Toys. While this clearly can be a red flag in many cases, the Playmates CEO (Michael Chan) is well credentialed (previously worked at KKR in PE), has been with the company since 2010, and appears to have executed well since his appointment to CEO in 2021. Remuneration is reasonable with Chan’s total comp in 2022 equivalent to USD320k.

Risks

Opaque licensing: Playmates intentionally gives very few details about its TMNT contract, which is clearly a critical risk to the business if lost. Expiry and major terms are unknown, however Playmates does reveal $HK190m of future licensing commitments over the next 5 years which hints that there is no immediate contract expiry.

Highly cyclical business, dependent on TMNT interest: as addressed previously, there are no guarantees of a major sales uplift despite the movie / tv series pipeline, it will ultimately be dependent on its popularity with consumers whose options for entertainment has never been higher.

Capital Allocation: while it has been signalled, there is no guarantee that excess earnings will be ultimately distributed to shareholders and not kept on balance sheet or used to purse potentially value destructive M&A.

Family business with controlling shareholder: as noted above, Playmates is a family business controlled by Playmates Holdings (51% shareholder) with intercompany arrangements including renting office space from PH (negotiated at prevailing market rents) in HK and London.

Supplier/Customer Risk: Playmates has a relatively concentrated supply chain (largest supplier is 31% of purchases, all are HK/China based) and major customers (top 5 are 70% of sales).

Macro conditions: Playmates is a consumer discretionary business, and as such is more exposed than a typical business to sustained economic downturn.

Conclusion

As a result of its significant earnings volatility, and product concentration issues, Playmates has historically been (and still remains currently), a lightly followed business that trades at a discount to net cash on its balance sheet.

However, I believe Playmates has an attractive combination of downside protection (via its cash balance) plus strong positioning for a valuation re-rate as the market recognises the range of tailwinds now supporting medium term earnings;

Demonstrated profitability in recent earnings periods without a major TMNT product line contribution

Strongly received recent TMNT movie release, with a tv series and sequel movie greenlit to follow

Significantly higher earnings from cash balance as a result of elevated interest rates of 5%+ on short-term US treasuries

Demonstration in 2023 of management willingness to distribute excess capital via dividends

Improved optionality to sign an additional Tier 1 partnership

Disclaimer

Do not interpret anything above as financial advice. This article has been prepared for informational & educational purposes only. The writing contains certain forward-looking statements and opinions which are based on the Author’s analysis of publicly available information believed to be accurate and reliable. These statements and opinions are subject to unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. As of the date the Report is published, the Author holds a position in the security mentioned. Nothing in this Report constitutes investment advice. Readers should conduct their own due diligence and research and make their own investment decisions.

What do you think about Playmates Holding potentially going private? Ownership has been creeping up for years now.